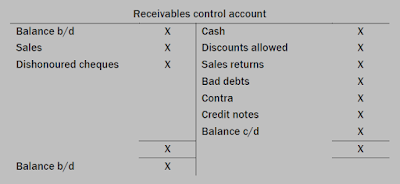

The receivables control account

The receivables control account is an account

for recording the value of transactions in total with credit customers. The

balance on the receivables control account (debit balance) is the total amount

currently owed by all customers.

The receivables control account will contain

some or all of the totals to date for all

of the following postings to the account.

Illustration:

|

| receivables control account |

There must also be individual accounts for each credit

customer in a separate receivables ledger.

Receivables control account reconciliation

Reconciliation means making sure that two

figures or totals are consistent with each other and agree with each other. The

control accounts in an accounting system can be used for control purposes, to

make sure that transactions have been recorded correctly in the accounts.

This is because if the transactions have been

recorded correctly the balance on the receivables control account in the

general ledger should equal the total of the balances on all the individual

customer accounts in the receivables ledger. A reconciliation check can be made

to make sure that these totals are the same. If they are different, the cause

of the error (or errors) should be found and corrected.

A receivables control account reconciliation

involves a comparison between the totals, looking for the reasons for any

differences between them, and correcting errors that are discovered in the

checking process.

Why might there be differences?

The balance on the receivables ledger control

account might differ from the total of all the balances on the accounts in the

receivables ledger for the following reasons:

Illustration: Possible errors

Error Correction

1 The total of the credit sales in the sales day book is

correctly debited to the receivables control account but one of the individual transactions

is not posted from the sales day book to the individual accounts in the receivables

ledger.

Adjust the individual customer’s balance

2 The total of cash received from customers, recorded in the

cash book, has been posted

correctly to the receivables ledger control account, but a

receipt from a customer is not posted from the cash book to the individual accounts

in the receivables ledger.

Adjust the individual customer’s balance

3 The sales day book may be added up incorrectly so that the wrong

amount is posted to the receivables ledger control but the individual accounts

in the receivables ledger are correctly updated.

Adjust the receivables ledger control account in the general

ledger.

4 A contra entry might be recorded in the general ledger but not

in the receivables ledger (or vice versa)

Adjust the appropriate record for the missing entry

The errors described above do not result in

differences in the total of debit and credit entries in the general ledger. Consequently, the

existence of an error will not be discovered by preparing a trial balance. However,

these errors should be discovered by a control account reconciliation.

Preparing a receivables control account reconciliation

To make a control account reconciliation, the

starting point is to compare the control account balance with the total of all

the balances on the individual customer (receivables ledger) or supplier

(payables ledger) accounts.

If the totals differ, the reasons for the

difference need to be discovered. When the reasons are discovered, the errors must

be corrected. A correction might involve:

- changing the control account balance, or

- changing one or more balances on individual customer or supplier accounts.

The two totals should be equal after all

corrections have been made. If a difference still remains between the totals,

this means that at least one error remains undetected.

The payables control account

The payables control account is an account

for recording the value of credit purchase transactions in total. The balance

on the payables control account (credit balance) is the total amount currently

owed to all suppliers.

There must also be individual accounts for

each credit suppliers in a separate payables ledger.

The payables control account is an account

for recording the value of credit transactions in total with suppliers. The

balance on the payables control account (credit balance) is the total amount

currently owed to all trade suppliers.

The payables control account will contain

some or all of the totals to date for all of the following postings to the

account.

Illustration:

|

| payables control account |

There must be individual accounts for each supplier in a

separate payables ledger.

Payables control account reconciliation

A payables control account reconciliation

involves a comparison between the totals on the payables control account and

the list of balances in the payables ledger.

Why might there be differences?

The balance on the payables ledger control

account might differ from the total of all the balances on the accounts in the

payables ledger for the following reasons:

Illustration: Possible errors

Error Correction

1 The total of the credit purchases in the purchases day

book is correctly credited to

the payables control account but one of the individual

transactions is not posted from the purchases day book to the individual accounts

in the payables ledger.

Adjust the individual customer’s balance

2 The total of cash paid to suppliers, recorded in the cash

book, has been posted correctly to the payables ledger control account, but a payment

to a supplier is not posted from the cash book to the individual accounts in

the payables ledger.

Adjust the individual customer’s balance

3 The purchases day book may be added up incorrectly so that

the wrong amount is posted to the payables ledger control but the individual

accounts in the payables ledger are correctly updated.

Adjust the payables ledger control account in the general ledger.

4 A contra entry might be recorded in the general ledger but

not in the payables ledger (or vice versa)

Adjust the appropriate record for the missing entry

Read Also: Some other Issues of Inventory

This is because if the transactions have been recorded correctly the balance on the receivables control account in the general ledger should equal the total of the balances on all the individual customer accounts in the receivables ledger. A reconciliation check can be made to make sure that these totals are the same. If they are different, the cause of the error (or errors) should be found and corrected.Thanks for sharing Valuable Information and it's very helpful. Being Best Top ca Final institute in bangalore One of the Leading Coaching Centres in bangalore for Chartered Accountancy.

ReplyDeleteThanks for sharing useful Information for the reasearch and it's very helpful.The total of cash paid to suppliers, recorded in the cash book, has been posted correctly to the payables ledger control account, but a payment to a supplier is not posted from the cash book to the individual accounts in the payables ledger. Being best ca coaching in hyderabad . One of the Leading Coaching Centres in Hyderabad for Chartered Accountancy.

ReplyDeleteThanks for sharing useful Information. To make a control account reconciliation, the starting point is to compare the control account balance with the total of all the balances on the individual customer (receivables ledger) or supplier (payables ledger) accounts. Being Best ca course fees in coimbatore . One of the Leading Coaching Centres in Coimbatore for Chartered Accountancy.

ReplyDeleteThanks for sharing useful Information. If the totals differ, the reasons for the difference need to be discovered. When the reasons are discovered, the errors must be corrected. A correction might involve. Being Best US CMA coaching centre in Coimbatore One of the Leading Coaching Centres in Coimbatore for Chartered Accountancy.

ReplyDeleteAdvanced corporate access control in Singapore helps meet compliance and safety regulations. advanced access control Singapore for corporate security

ReplyDelete