-

IntroductionA business might make all its sales for cash but many businesses make some or even all their sales on credit. There is often no alternative to offering credit to customers. If competitors offer credit, then a business will have little alternative but to offer credit as well so as not to lose custom. A major benefit of offering credit is that it usually increases revenue, compared to what revenue would be if all sales were for cash.

If sales are made on credit, there is always a chance that some customers will fall into financial difficulty and be unable to pay what they owe.It would be misleading to the users of the financial statements if a business continued to show receivables where is no chance, or only a slight chance of collecting them.The application of the concept of prudence would require that there should be an adjustment to reflect the fact that there are some receivables which the business thinks that it will not recover.There are two categories of problem receivables for which adjustment might be required.Bad debts (also known as irrecoverable debts or receivables)A bad debt is an amount owed by a customer that the business believes it will never be able to collect.Examples of circumstances that might lead to the conclusion that a receivable is irrecoverable include:- The bankruptcy or insolvency of a customer.

- The death of a customer who has left insufficient assets to pay off his debts.

- A dispute with a customer over whether a contract has been fulfilled or not.

- The dishonesty of a customer (where a person has obtained goods on credit with no intention to pay).

Doubtful debtsA doubtful debt is an amount owed by a customer that the business believes might prove difficult to collect but they still hope to do so. For example, the business might know that the customer is in difficulty but that he might be able to work his way out of it. This casts doubt on the collectability of the receivable but it still might be possible if the customer is able to recover from his difficulties.Examples of circumstances that might lead to the conclusion that a receivable is doubtful include:- A customer experiencing cash flow problems.

- A customer taking an unusually long time to settle a debt.

- A customer experiencing operational difficulties which might lead to financial problems (for example, strikes, natural disasters disrupting production etc.).

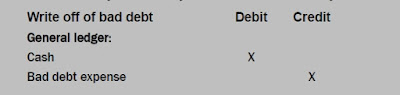

Bad debts and doubtful debts are accounted for differently, although there is often just a single bad and doubtful debts expense account in the general ledger.PrudenceA business should not show an asset in its financial statements at an amount greater than the cash it will generate. When such a circumstance arises the asset is reduced in value down to the cash expected to result from the ownership of the asset.2. Accounting for bad debtsBad debts are receivables that an entity is owed, but that it now does not expect to collect.When a specific debt (receivable) is considered bad or irrecoverable, it is written off. This means that it is removed from the accounting system and supporting records.Illustration: Write off of bad debt – double entry

Write off of bad debt – double entry When a bad debt is written off, it is reduced to zero in the receivables ledger (and total receivables account):- The total value of receivables is reduced (reducing assets).

- The bad debt is recorded as an expense (reducing profit and hence capital).

3. Bad debts recoveredOn rare occasions cash in respect of a debt that had been written off as bad in a previous year is subsequently received in a later period. The double entry for recording the recovery of a bad debt is:Illustration: Subsequent recovery of bad debt – double entry

Subsequent recovery of bad debt – double entry The credit reduces the bad debt expense account. This recognises that the business had previously recognised an expense when it first wrote off the debt where, in hindsight, it need not have done so.

BAD DEBTS AND DOUBTFUL DEBTS

Subscribe to:

Post Comments (Atom)

i Learned that If sales are made on credit, there is always a chance that some customers will fall into financial difficulty and be unable to pay what they owe.Thanks for sharing useful Information with me and it's very helpful. Being Best CA coaching Centre in Hyderabad One of the Leading Coaching Centres in Hyderabad for Chartered Accountancy.

ReplyDelete