Method 1: the ‘two account’ approach

for accrued expenses

This is the easier approach. Also note that

it is the method used in computerized accounting systems.

The accrued expense is recorded in an accrued

expenses account. The double entry for this adjustment is as follows

Illustration:

Accruals using two accounts.

Debit Credit

Expense account X

Accruals account X

This adds the accrued expense to the expenses recognised

as the result of having received invoices earlier in the current accounting

period.

The credit balance on the accruals account is a liability,

and is included in the statement of financial position as a current liability.

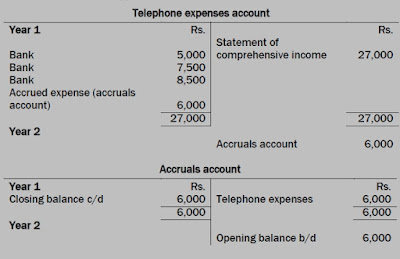

Example: Year 1

Payments

in the year were:

Rs.

30

April 5,000

31

July 7,500

31

October 8,500

The accrual for November and

December Year 1 is Rs. 6,000 (Rs. 9,000 × 2/3).

Method 1: two

account approach

|

Method 1: two

account approach

|

The

expense in the statement of comprehensive income for Year 1 is Rs. 27,000 and

the accrued expense of Rs. 6,000 is included in the statement of financial position

as a current liability at the end of Year 1.

Reversal of the accrual

There is a complication. At the year end the

expense account is cleared to the statement of comprehensive income and there is

a credit balance carried down on the accruals account.

Assume that the invoice that arrives in

January is Rs. 9,500. The accounting system will record the following double

entry:

Example: January

invoice received

|

|

invoice received |

However, an expense of Rs. 6,000 and a liability of Rs.

6,000 has already been recognised in respect of this invoice. If no further

adjustment is made the 6,000 is being included twice.

In

Year 2, the telephone invoices are as follows:

Rs.

31

January 9,500

30

April 9,500

31

July 10,000

31

October 10,000

To

calculate the telephone expenses for Year 2, it is necessary to estimate the expense

for November and December, and to make an accrual.

The

next invoice (at the end of January Year 3) is expected to be Rs. 10,500.

The

accrual for November and December Year 1 should be Rs. 7,000 (Rs. 10,500 × 2/3).

Method 2: the ‘one account’ approach

for accrued expenses

This approach is trickier to understand. The

accrual is recognised in the expense account.

There are two ways of achieving this.

- The total expense can be

calculated and transferred to the statement of comprehensive income (Dr

Statement of comprehensive income; Cr

Expense account) leaving a balancing figure

on the expense account as an accrual; or

- The accrual can be

calculated and recognised in the expense account leaving the amount transferred

to the statement of comprehensive income

(Dr Statement of comprehensive income; Cr

Expense account) as a balancing figure

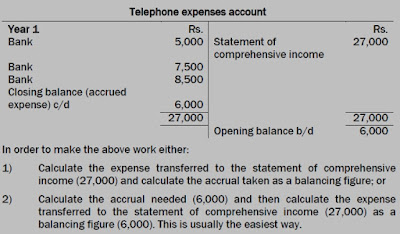

Example: Year 1

Wasif set up in business on 1 January Year 1. The business has a

31 December year end.

The business acquired a telephone system on 1 February.

Telephone charges are paid every 3 three months in arrears and

telephone invoices received in Year 1 are as follows:

Rs.

30 April 5,000

31 July 7,500

31 October 8,500

To calculate the telephone expenses for Year 1, it is necessary to

estimate the expense for November and December, and to make an accrual.

The next invoice (at the end of January Year 2) is expected to be

Rs. 9,000.

The accrual for November and December Year 1 should be Rs. 6,000

(Rs. 9,000 × 2/3).

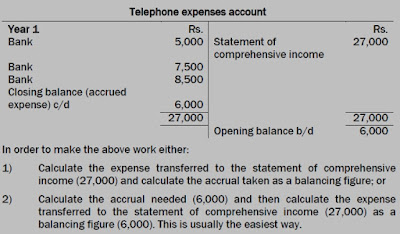

Method 2: one account approach

|

| one account approach |

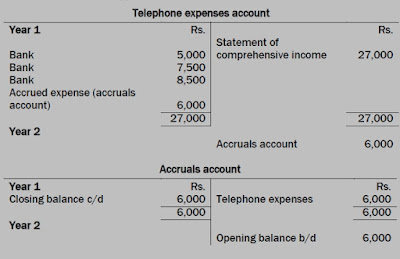

In

order to make the above work either:

- Calculate the expense transferred to the statement of comprehensive income

(27,000) and calculate the accrual taken as a balancing figure; or

- Calculate the accrual needed (6,000) and then calculate the expense transferred

to the statement of comprehensive income (27,000) as a balancing figure

(6,000). This is usually the easiest way.

There is no need to reverse the accrual using the one

account method as it is nalready in the expense account at the start of the

next year.

Calculating the expense for the statement of comprehensive

income

Method 2 requires the calculation of either

the closing accrual or the charge to the statement of comprehensive income, the

other number being taken as a balancing figure. It is almost always easier

to calculate the accrual.

The amount charged to the statement of

comprehensive income can be calculated as follows. It is worth spending a

little time trying to understand this.

Illustration:

Rs.

Invoices/payments for the year X

+ Closing accrued expense X

X

– Opening accrued expense (X)

= Expense for the year X